Are we still talking about a Greek exit!

Just have done with it already.

Markets and creditors have had 6 years or more now, to get used to the idea of losing money on loans.

To some degree, I would suggest that creditors know the capital is gone, but the bigger issue is the debt service payments that 'grease' the cash-flow.

Like an investment in rental property, or companies paying big on utility assets, the capital is spent/tied up upfront, but then the investor can look forward to many years of interest (service payments).

As things stand I'm not sure I would believe anything from this latest bunch of democratically elected charlatans given their last "last minute" payment to the IMF from unknown accounts.

And if they think they can go on and sort their own mess out with a return to the drachma, good luck to them.

As they have reminded "everyone" they have no credit worthiness that allows them access to international markets, but neither did Iceland, but Iceland have managed to repair their situation independently and have been credit worthy again for some time now.

If the country is serious about recovery then a devalued currency to boost competitiveness is what is needed to boost the national industries (and has been from the beginning), the biggest of which that come to mind being shipping, and tourism.

This bunch appear to have a strategy of sowing the seeds of fear internationally, and involving/appealing to as many as possible to reduce the terms of their agreements.

But if they are unable to implement the taxes, and cuts required to recover whilst being supported, how are they going to do it without the EU.

The truth is that the country's politicians want to remain in the EU, but the latest government seem set on a transparent strategy of holding the EU and its creditors to ransom, in order to continue to coast along for as long as possible on the best possible benefits.

And sadly, what the electorate have failed to realise is that many politicians will tap into the majority concerns of the population, promise miracles in order to get elected, and then come up with any number of reasons as to why they can't now deliver, meanwhile their personal futures, and pensions are secured, and career ambitions fulfilled.

They are playing poker but not with their own stakes, instead they are using the country's population and its future.

They should have a referendum on their continued membership, or perhaps the rest of the EU?

A diary charting the thoughts, investing strategies, share investments, and stock market experiences (both good and bad), of a private investor.

Wednesday, 1 July 2015

Monday, 8 June 2015

May 2015: Rolling Dividend Update.

May brought a near avalanche of dividends with Verizon, BAT's, Banco Santander, Aviva, Apple, BG Group, and Barratt Developments all paying out and throwing cash at my portfolio (May 2015: Portfolio Update.).

In the meantime, BP, Microsoft, and Imperial Tobacco started to trade ex. dividend, adding to BAE, Centrica, and William Hill.

So that's currently 6 portfolio holdings trading with an ex. dividend reflected share price, and my portfolio having yet to receive it.

A hidden bit of value, albeit a small one.

Dps | Ex Div. | Paid | |

| GE | 12.72p | 19-Feb | 27-Apr |

| BAT | 100.60p | 19-Mar | 07-May |

| Aviva | 12.25p | 08-Apr | 15-May |

| Verizon Comm. | 30.79p | 08-Apr | 01-May |

| Banco Santander | 8.74p | 14-Apr | 04-May |

| BAE | 12.30p | 16-Apr | 01-Jun |

| Barratt Dev. | 4.80p | 23-Apr | 22-May |

| Rolls-Royce | 14.10p | 23-Apr | 01-Jul |

| BG Group Centrica | 9.52p 8.40p | 23-Apr 30-Apr | 22-May 25-Jun |

| William Hill | 8.20p | 30-Apr | 05-Jun |

| Apple | 27.90p | 07-May | 14-May |

| BP | $0.10 est. | 07-May | 19-Jun |

| Microsoft | $0.31 est. | 19-May | 11-Jun |

| Imperial Tob. | 21.40p | 28-May | 30-Jun |

| National Grid | 28.16p | 04-Jun | 05-Aug |

| Vodafone SSE Imperial Tob. | 7.62p 61.80p 21.40p | 11-Jun 23-Jul 27-Aug | 05-Aug 18-Sep 30-Sep |

Looking ahead, I can see 2 more companies due to go ex. dividend in June, Vodafone and National Grid, the second a significant one in context of my portfolio as it is currently the largest actual payout among my holdings.

However, BAE, William Hill, Microsoft, BP, Centrica, and Imperial Tobacco, are due to make deposits into my account, which should reduce the in limbo companies yet to pay to just 2 by the end of June.

Interesting.

Monday, 1 June 2015

May 2015: Portfolio Update.

May has ended with my portfolio again flirting with new highs, by achieving a new all time 133.18% month end high.

I think there was probably also an unmarked intra month high exceeding my previously posted observation (Interesting end to the week!).

Anyway, William Hill quietly took the laurels during May with a 16.59% gain going largely unnoticed as the company continues to benefit from a post election buzz.

Barratt, Centrica, and SSE also continued to benefit from the same momentum.

And, almost immediately after my post observing the market's reaction to Vodafone's results (Vodafone "off the hook"?), the share price bounced with rumours of mergers and tie-ups.

Apple, IG, and National Grid also added to the feel good momentum, and combined with the numerous dividends this month, facilitated a 1.46% gain in the month.

Aviva weighed in with the largest dividend contribution, with others also coming from BAT, Verizon, BG, Barratt, Banco-Santander and Apple.

In contrast, the FTSE100 notched up a 0.34% gain.

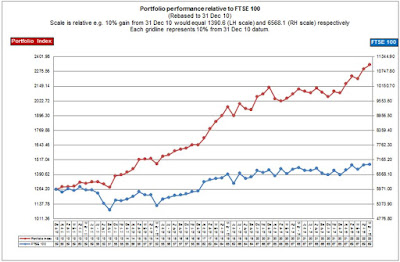

The chart is now showing a new sharply rising trend that started in January 2015 and has continued to move away from the FTSE100.

Despite markets now potentially moving into the mid year doldrums, ongoing concerns around global growth affecting supply and demand in oil and commodities, and Grexit fears, June, through to August looks a good period for portfolio dividends given contributions from R-R, BP, National Grid, and Imperial Tobacco, to look forward to.

And despite still kicking myself over the ones that might have got away, I am still watching, and waiting.

Lloyd's is going to be a difficult one to judge given the news that the Gov't plan to sell off the rump of the remainder. Will that discount the current price?

Bellway is still climbing but the North East construction specialist continues to trade at a discount to the sector trading at a forward price to earnings of 10 (8 times was available pre-election!).

And, following its own break-up, BHP Billiton, is now trading on a forward pe of 14.8 rising to 20.4, supported by a dividend of 5.8 - 6%.

I also need to sit down and calculate some comparisons with VW given the continued weakening of the Euro which might be giving me another chance to drive away a new purchase!

Anyway, we continue to trade in stormy waters but markets are holding up surprisingly well.

Related Posts:

- Interesting end to the week!

- Vodafone "off the hook"?

- Additional News to the post: Vodafone "off the hook"?

- Dividend Pipeline!

I think there was probably also an unmarked intra month high exceeding my previously posted observation (Interesting end to the week!).

Anyway, William Hill quietly took the laurels during May with a 16.59% gain going largely unnoticed as the company continues to benefit from a post election buzz.

Barratt, Centrica, and SSE also continued to benefit from the same momentum.

And, almost immediately after my post observing the market's reaction to Vodafone's results (Vodafone "off the hook"?), the share price bounced with rumours of mergers and tie-ups.

Apple, IG, and National Grid also added to the feel good momentum, and combined with the numerous dividends this month, facilitated a 1.46% gain in the month.

Aviva weighed in with the largest dividend contribution, with others also coming from BAT, Verizon, BG, Barratt, Banco-Santander and Apple.

In contrast, the FTSE100 notched up a 0.34% gain.

| Forecast | 1 month | YTD | 53 mth | ||||||

| Price | % holding | Div. yield | % gain | % gain | % gain | ||||

| R-R | 998.00p | 23.41% | 2.38% | -4.59% | 14.71% | 52.02% | |||

| Aviva | 523.50p | 12.28% | 4.03% | -0.66% | 8.05% | 44.70% | |||

| National Grid | 934.00p | 13.31% | 4.79% | 6.26% | 1.73% | 68.90% | |||

| BP | 450.75p | 9.09% | 5.79% | -4.10% | 9.67% | 6.52% | |||

| Apple ** | $130.28 | 8.72% | 1.31% | 5.69% | 21.64% | 136.61% | |||

| IG Group | 781.50p | 4.55% | 4.01% | 6.04% | 8.69% | 63.77% | |||

| Imperial Tobacco | 3370.00p | 3.06% | 4.17% | 5.58% | 18.83% | 49.18% | |||

| William Hill | 420.90p | 3.10% | 3.01% | 16.59% | 16.11% | 128.53% | |||

| BAT | 3605.50p | 2.22% | 4.33% | 0.38% | 3.01% | 7.49% | |||

| Vodafone | 255.35p | 2.26% | 4.61% | 10.54% | 14.69% | 1.21% | |||

| Microsoft ** | $46.86 | 2.06% | 2.17% | -2.19% | 3.97% | 73.08% | |||

| Banco Santander | 466.00p | 1.76% | 2.86% | -4.51% | -14.42% | -14.61% | |||

| General Electric ** | $27.27 | 1.90% | 2.88% | 2.24% | 11.21% | 84.36% | |||

| BAE Systems | 515.00p | 1.66% | 4.07% | 1.38% | 9.11% | 56.06% | |||

| Barratt Dev. | 592.00p | 1.71% | 3.90% | 14.07% | 25.69% | 65.61% | |||

| SSE | 1665.00p | 1.49% | 5.50% | 7.63% | 2.65% | 35.92% | |||

| Verizon ** | 3269.01p | 1.38% | 3.82% | -0.48% | 8.92% | 17.79% | |||

| Centrica | 277.60p | 1.13% | 4.52% | 8.86% | -0.50% | -16.28% | |||

| BG Group | 1137.00p | 2.57% | 1.97% | -3.81% | 31.45% | -7.49% | |||

| Cash | 2.32% | 0.00% | |||||||

| 100.00% | 3.46% | ||||||||

| 1 month | YTD | 53 mth | |||||||

| Virtual Portfolio gain (incl. Dividends) | |||||||||

| - 1 month gain 2298.27 - | 2331.79 | 1.46% | |||||||

| - YTD gain 1644.62 - | 2331.79 | 11.56% | |||||||

| - 53 month gain 1264.20 - | 2331.79 | 84.45% | |||||||

| - 65 month gain 1000.00 - | 2331.79 | 133.18% | |||||||

| Unit Price - £ | 2.33179 | (Starting price - £1) | |||||||

| FTSE gain (excl. Dividends) | |||||||||

| - 1 month gain 6960.63 - | 6984.43 | 0.34% | |||||||

| - YTD gain 5897.81 - | 6984.43 | 6.37% | |||||||

| - 53 month gain 5971.01 - | 6984.43 | 16.97% | |||||||

| - 65 month gain 5412.88 - | 6984.43 | 29.03% | |||||||

| Transactions: | |||||||||

| 06/05/2015 | Div | Verizon @ 30.79p per share | |||||||

| 07/05/2015 | Div | BAT @ 100.60p per share | |||||||

| 08/05/2015 | Div | Banco Santander @ 8.74p per share | |||||||

| 15/05/2015 | Div | Aviva @ 12.25p per share | |||||||

| 18/05/2015 | Div | Apple @ 27.90p per share | |||||||

| 20/05/2015 | Div | Barrat Dev. @ 4.80p per share | |||||||

| 22/05/2015 | Div | BG Group @ 9.52p per share | |||||||

| Notes: | |||||||||

| * US Dividends are adjusted for exchange rate and 15% withholding tax | |||||||||

| ** Sterling : Dollar exchange rate = £1: $1.51239 as at 31/05/15 | |||||||||

| *** Banco Dividends are adjusted for exchange rate and 21% withholding tax | |||||||||

| **** Sterling : Euro exchange rate = £1: $1.39106 as at 31/05/15 | |||||||||

The chart is now showing a new sharply rising trend that started in January 2015 and has continued to move away from the FTSE100.

|

| Click to enlarge, close to return. |

Despite markets now potentially moving into the mid year doldrums, ongoing concerns around global growth affecting supply and demand in oil and commodities, and Grexit fears, June, through to August looks a good period for portfolio dividends given contributions from R-R, BP, National Grid, and Imperial Tobacco, to look forward to.

And despite still kicking myself over the ones that might have got away, I am still watching, and waiting.

Lloyd's is going to be a difficult one to judge given the news that the Gov't plan to sell off the rump of the remainder. Will that discount the current price?

Bellway is still climbing but the North East construction specialist continues to trade at a discount to the sector trading at a forward price to earnings of 10 (8 times was available pre-election!).

And, following its own break-up, BHP Billiton, is now trading on a forward pe of 14.8 rising to 20.4, supported by a dividend of 5.8 - 6%.

I also need to sit down and calculate some comparisons with VW given the continued weakening of the Euro which might be giving me another chance to drive away a new purchase!

Anyway, we continue to trade in stormy waters but markets are holding up surprisingly well.

Related Posts:

- Interesting end to the week!

- Vodafone "off the hook"?

- Additional News to the post: Vodafone "off the hook"?

- Dividend Pipeline!

Wednesday, 20 May 2015

Dividend Pipeline!

OK so dividends then.

Obviously I monitor them as month by month receipts into my portfolio but, I'm still running with this idea of monitoring the pipeline so thought I should start by seeing exactly whats in the pipeline.

As briefly referenced, in theory having gone ex dividend, a chunk of a company's capital has been sliced off its share price equivalent to the dividend, therefore trading ex. dividend, but until the dividend is actually paid out, it isn't in either the company's share price, or the shareholders account.

So looking at my portfolio, this is the current window

National Grid is based on last year's, as it hasn't yet been declared as results aren't due to be announced until the 21 May.

BP's currently shows in USD, as does Microsoft so they are subject to the exchange rate. The latter also being subject to US withholding tax.

Interesting to see how long some companies take to make the actual payment after the XD date.

Apple has been exceptionally quick, but most seem to be spanning a month, although BAE seem to be around 6 weeks, Vodafone 8 weeks, and (just noticed), Rolls-Royce on 9 weeks!).

But this doesn't show how close the XD date is to the results announcement or even the link to the company's year-end.

Its just an interesting question as to whether delays or lengthy timescales for year-end to results to XD to payment, are used to the advantage of companies and their cashflow?

But that's a tangent, and the goal here is to see the pipeline of dividends, and if needed, to understand how much "cash" is due but not yet in my portfolio, a hidden value.

In this case, BAT, Aviva, Verizon, Banco, and Apple have paid out and it should be in my account.

But Barratt, BAE, Rolls-Royce, Centrica, William Hill, BP and Microsoft are all trading with XD share prices, affecting my portfolio, but I'm not yet looking at the complete picture as the dividends have not yet been paid to complete the circle.

If nothing else it shows me that the wheels are still turning as we move into the middle third of the year.

Obviously I monitor them as month by month receipts into my portfolio but, I'm still running with this idea of monitoring the pipeline so thought I should start by seeing exactly whats in the pipeline.

As briefly referenced, in theory having gone ex dividend, a chunk of a company's capital has been sliced off its share price equivalent to the dividend, therefore trading ex. dividend, but until the dividend is actually paid out, it isn't in either the company's share price, or the shareholders account.

So looking at my portfolio, this is the current window

| Dps | Ex Div. | Paid | |

| GE | 12.72p | 19-Feb | 27-Apr |

| BAT | 100.60p | 19-Mar | 07-May |

| Aviva | 12.25p | 08-Apr | 15-May |

| Verizon Comm. | 30.79p | 08-Apr | 01-May |

| Banco Santander | 8.70p | 14-Apr | 04-May |

| BAE | 12.30p | 16-Apr | 01-Jun |

| Barratt Dev. | 4.80p | 23-Apr | 22-May |

| Rolls-Royce | 14.10p | 23-Apr | 01-Jul |

| Centrica | 8.40p | 30-Apr | 25-Jun |

| William Hill | 8.20p | 30-Apr | 05-Jun |

| Apple | 27.90p | 07-May | 14-May |

| BP | $0.10 est. | 07-May | 19-Jun |

| Microsoft | $0.31 est. | 19-May | 11-Jun |

| Imperial Tob. | 21.40p | 28-May | 30-Jun |

| National Grid | 27.54p est | 04-Jun | |

| Vodafone | 7.62p | 11-Jun | 05-Aug |

National Grid is based on last year's, as it hasn't yet been declared as results aren't due to be announced until the 21 May.

BP's currently shows in USD, as does Microsoft so they are subject to the exchange rate. The latter also being subject to US withholding tax.

Interesting to see how long some companies take to make the actual payment after the XD date.

Apple has been exceptionally quick, but most seem to be spanning a month, although BAE seem to be around 6 weeks, Vodafone 8 weeks, and (just noticed), Rolls-Royce on 9 weeks!).

But this doesn't show how close the XD date is to the results announcement or even the link to the company's year-end.

Its just an interesting question as to whether delays or lengthy timescales for year-end to results to XD to payment, are used to the advantage of companies and their cashflow?

But that's a tangent, and the goal here is to see the pipeline of dividends, and if needed, to understand how much "cash" is due but not yet in my portfolio, a hidden value.

In this case, BAT, Aviva, Verizon, Banco, and Apple have paid out and it should be in my account.

But Barratt, BAE, Rolls-Royce, Centrica, William Hill, BP and Microsoft are all trading with XD share prices, affecting my portfolio, but I'm not yet looking at the complete picture as the dividends have not yet been paid to complete the circle.

If nothing else it shows me that the wheels are still turning as we move into the middle third of the year.

Tuesday, 19 May 2015

Additional News to the post: Vodafone "off the hook"?

FTSE100 @ 6990.91, +22.04 (+0.32%)

Vodafone @ 226.3p, -7.8p (-3.33%)

Some additional news re. analysts reactions to Vodafone's results, sharecast.com: Vodafone's Project Spring fails to deliver bounce for Nomura and SocGen

Helps to explain the pull back in the shares today although it still seems confusing given comments such as:

"beating consensus forecasts for the final three months of the year."

"The telecoms giant's 7% decline in EBITDA, though expected, disappointed analysts who had hoped for more of a boost from the first year of its Project Spring programme."

"Beating consensus", and "though expected", would seem to be confirming comments to support the results but then its all undermined in this particular summary that a "hoped for ..... boost from the first year of its Project Spring program.", would justify a company valuation.

We can all hope can't we?

I guess the one justification is that consensus and an individual analyst's view (as in these 2 brokers), aren't quite the same thing.

Previous post:

- Vodafone "off the hook"?

Related article links:

- www.sharecast.com: Vodafone's Project Spring fails to deliver bounce for Nomura and SocGen

- www.sharecast.com: FTSE 100 movers: BHP Billiton extends losses, Land Securities surges on higher dividend

Vodafone @ 226.3p, -7.8p (-3.33%)

Some additional news re. analysts reactions to Vodafone's results, sharecast.com: Vodafone's Project Spring fails to deliver bounce for Nomura and SocGen

Helps to explain the pull back in the shares today although it still seems confusing given comments such as:

"beating consensus forecasts for the final three months of the year."

"The telecoms giant's 7% decline in EBITDA, though expected, disappointed analysts who had hoped for more of a boost from the first year of its Project Spring programme."

"Beating consensus", and "though expected", would seem to be confirming comments to support the results but then its all undermined in this particular summary that a "hoped for ..... boost from the first year of its Project Spring program.", would justify a company valuation.

We can all hope can't we?

I guess the one justification is that consensus and an individual analyst's view (as in these 2 brokers), aren't quite the same thing.

Previous post:

- Vodafone "off the hook"?

Related article links:

- www.sharecast.com: Vodafone's Project Spring fails to deliver bounce for Nomura and SocGen

- www.sharecast.com: FTSE 100 movers: BHP Billiton extends losses, Land Securities surges on higher dividend

Labels:

Vodafone

Vodafone "off the hook"?

Always entertaining to see how valuations react to news, in this case its Vodafone.

After a year of seismic change, the shares have held up well albeit moving in a large range.

However, the last few months has seen some momentum a midst positive comments from analysts about the company's chances of returning to organic growth.

In its results announcement today the company has, in fact reported that the fourth quarter saw its service revenues return to organic growth, albeit by a figure of 0.1%, a figure thats we're also being told actually beat consensus forecasts! (sharecast.com: Vodafone returns to organic growth as data demand soars).

And yet, even in a market showing positive for the day, the share price has actually fallen, by an amount that seems greater than the normal day to day movements in Vodafone.

FTSE 100 @ 6999.60, +30.73 (+0.44%)

Vodafone @ 227.1p, -7p (-2.99%), as at 9:24 am

So that's a 3% move against market sentiment, and running in the opposite direction to results beating consensus!

The company announced a dividend of 7.62p (+2%), but doesn't go ex dividend until 7th June, and appear to have made a strategic statement to grow it.

There's cash on the balance sheet, and capex spending (and inversely debt and cashflow), appears to be in line with previous communications including Project Spring.

From a different view, I would agree that the valuation seems high when based on measures such as p/e which suggests that it has been supported by the prospect of a 5% dividend and the potential recovery in its main markets, and the investment in Project Spring.

So that being the case, that its currently supported by its dividend, European recovery, and Project Spring, it seems to me that today's results, and confirmation of progress, should have been better received than with a fall against the market?

Always interesting, and entertaining then but, in the short term at least, rarely logical or understandeable.

As ever, it continues to confirm (for me at least), the need to take a longer term view than the day to day industry that surrounds the financial markets.

Related article links:

- sharecast.com: Vodafone returns to organic growth as data demand soars

- www.vodafone.com: For Investors

- www.vodafone.com: Vodafone announces results for the year ended 31 March 2015

- www.vodafone.com: Preliminary results For the year ended 31 March 2015

Earlier posts:

- Vodafone: "Deal or no deal" on Verizon Wireless!

After a year of seismic change, the shares have held up well albeit moving in a large range.

However, the last few months has seen some momentum a midst positive comments from analysts about the company's chances of returning to organic growth.

In its results announcement today the company has, in fact reported that the fourth quarter saw its service revenues return to organic growth, albeit by a figure of 0.1%, a figure thats we're also being told actually beat consensus forecasts! (sharecast.com: Vodafone returns to organic growth as data demand soars).

And yet, even in a market showing positive for the day, the share price has actually fallen, by an amount that seems greater than the normal day to day movements in Vodafone.

FTSE 100 @ 6999.60, +30.73 (+0.44%)

Vodafone @ 227.1p, -7p (-2.99%), as at 9:24 am

So that's a 3% move against market sentiment, and running in the opposite direction to results beating consensus!

The company announced a dividend of 7.62p (+2%), but doesn't go ex dividend until 7th June, and appear to have made a strategic statement to grow it.

There's cash on the balance sheet, and capex spending (and inversely debt and cashflow), appears to be in line with previous communications including Project Spring.

From a different view, I would agree that the valuation seems high when based on measures such as p/e which suggests that it has been supported by the prospect of a 5% dividend and the potential recovery in its main markets, and the investment in Project Spring.

So that being the case, that its currently supported by its dividend, European recovery, and Project Spring, it seems to me that today's results, and confirmation of progress, should have been better received than with a fall against the market?

Always interesting, and entertaining then but, in the short term at least, rarely logical or understandeable.

As ever, it continues to confirm (for me at least), the need to take a longer term view than the day to day industry that surrounds the financial markets.

Related article links:

- sharecast.com: Vodafone returns to organic growth as data demand soars

- www.vodafone.com: For Investors

- www.vodafone.com: Vodafone announces results for the year ended 31 March 2015

- www.vodafone.com: Preliminary results For the year ended 31 March 2015

Earlier posts:

- Vodafone: "Deal or no deal" on Verizon Wireless!

Labels:

Vodafone

Monday, 18 May 2015

Broker views today and my portfolio/watchlist.

A collection of broker views printed today with potential impact on my some of holdings and watchlists:

R-R @ 1006p, - 7p (-0.69%)Rolls-Royce to cut 600 jobs in marine division by the end of 2015, (www.sharecast.com: Rolls-Royce to cut 600 jobs in marine division by the end of 2015

BP @ 451.65p, -0.75p (-0.17%)

BP dividend at risk as oil prices weaken, Goldman downgrades to 'sell', (www.sharecast.com: BP dividend at risk as oil prices weaken, Goldman downgrades to 'sell')

Lloyds @ 87.94p, -1.06p (-1.19%)

Investec downgrades Lloyds to 'sell' after recent share-price surge, (www.sharecast.com: Investec downgrades Lloyds to 'sell' after recent share-price surge)

BHP Billiton @ 1470p, -63p (-4.11%)Broker tips: BP, Lloyds, BHP Billiton, Weir Group, Bwin.party, ( www.sharecast.com: Broker tips: BP, Lloyds, BHP Billiton, Weir Group, Bwin.party)

Very much a wait and see on all fronts, although I would probably have expected news of further cost cutting at R-R to have seen a neutral/more positive reaction.And BP, as a play on the oil price is very much dependent upon it, but its interest to see the view that having already divested assets and that previously being seen as an advantage as oil prices have fallen, should now be seen as a disadvantage?

R-R @ 1006p, - 7p (-0.69%)Rolls-Royce to cut 600 jobs in marine division by the end of 2015, (www.sharecast.com: Rolls-Royce to cut 600 jobs in marine division by the end of 2015

BP @ 451.65p, -0.75p (-0.17%)

BP dividend at risk as oil prices weaken, Goldman downgrades to 'sell', (www.sharecast.com: BP dividend at risk as oil prices weaken, Goldman downgrades to 'sell')

Lloyds @ 87.94p, -1.06p (-1.19%)

Investec downgrades Lloyds to 'sell' after recent share-price surge, (www.sharecast.com: Investec downgrades Lloyds to 'sell' after recent share-price surge)

BHP Billiton @ 1470p, -63p (-4.11%)Broker tips: BP, Lloyds, BHP Billiton, Weir Group, Bwin.party, ( www.sharecast.com: Broker tips: BP, Lloyds, BHP Billiton, Weir Group, Bwin.party)

Very much a wait and see on all fronts, although I would probably have expected news of further cost cutting at R-R to have seen a neutral/more positive reaction.And BP, as a play on the oil price is very much dependent upon it, but its interest to see the view that having already divested assets and that previously being seen as an advantage as oil prices have fallen, should now be seen as a disadvantage?

Labels:

BHP Billiton,

BP,

Lloyds,

Rolls-Royce

Saturday, 16 May 2015

Contemplations and watchlists.

Frustrating few weeks watching and waiting, and telling myself to be patient.

But when does patience drift into fear and apathy?

Having worked hard this last few years to change behaviours and be patient, I've tried to wait for opportunities to buy targets, or at least for markets to pause for a few days, rather than jump in as soon as I have a mind to.

But, the last few weeks of volatility (could be said for this year so far even), and then break out news is proving frustrating for a number of candidates which have reacted to election forecasts and then election results with a smattering of reporting news thrown in for good measure.

So the companies I'm currently watching then:

Lloyds @ 89p, 52 week low - 71.92p;

BHP Billiton 1533p, 52 week low - 1276p;

Bellway @ 2230p, 52 week low - 1352p;

Telford Homes @ 485p, 52 week low - 267.25p;

Telecom Plus @ 831p, 52 week low - 752.5p

added to long running companies like:

Standard Chartered @ 1051.5p, 52 week low - 881p;

VW @ 215.3 Euros, 52 week low - 150.7 Euros, and 1 GBP: 1.38 Euro.

Google @ $546.49, 52 week low - $497.06, and £1: $1.57

Lloyds is very much back in the spotlight with a resumption of dividends, the hive-off of TSB, and the Governments reducing stake. The strategy of the latter seeming to be a saved up pressure to reduce the share price by force of numbers.

However, the recent trading statement ahead of the election reversed recent pullbacks with a 10% gain on the day, and this momentum continued after the election outcome.

But there could be momentum over the next few years as the company continues to "recover" and return to a norm of tangible returns in the form of a dividend,

BHP is off its lows this year and has an upcoming split off of lower value assets into a separate trading company to contend with but with the double impact of a floundering oil price and reduced commodity demand and prices, now might be a good entry point if you can believe that industrial demand for commodities and oil will return.

Bellway and Telford, are both in construction and stem from my frustration at not being able to build a stake in Barratts. Again, the potential of a different election outcome served to pull these companies back, but they have subsequently turned around with 10% gains.

Telecom Plus is still a quandary for me trading mainly through the Utilities Warehouse brand, it has retreated in recent months following disappointments but if the long term story is still intact then this could be a good entry point to a long term dividend play.

Standard Chartered is all about recovering its mojo. It has the obvious significant exposure to the Far East and emerging market, but has a slightly battered reputation to repair.

A new board is being put together but questions remain about the balance sheet and if a fund raising/dividend cut is still required.

The potential dividend cut being the pause on me, although if I had gone in at £8-£9 then I don't think I would be concerned but hindsight is a wonderful thing.

VW is another niggle as I seem to have watched it from 100 Euros to 175 Euros, pulling back to 130 and 150 Euros, before breaking 200 Euros. Again it appears to be pulling back and sits at 215 Euros.

Doubts over the Euro have held me back and currently I'm trying to understand if the current strength of sterling might give me a possible entry now that it appears to be 10% in sterling's favour.

Google might, or might not, seem an odd one, particularly as it has never paid a dividend, however, I have started to adopt the long term view of thinking which companies will still be around us in the future.

At some stage I expect Google will begin to pay a dividend, its just not close enough to predict currently.

And, as with utility companies, and the long running concerns over pricing and profits etc. I know that its likely I'm always going to need or be a customer of certain companies, so I might as well be a shareholder and for a small upfront investment, benefit year on year, in much the same way as if they were co-operatives.

If Google, or any other company, is going to be servicing you and your family, and your society, and the world over a lifetime, and be profitable, then they seem to be prime candidates for a long term, low maintenance portfolio regardless of economic cycles.

Google might, or might not, seem an odd one, particularly as it has never paid a dividend, however, I have started to adopt the long term view of thinking which companies will still be around us in the future.

At some stage I expect Google will begin to pay a dividend, its just not close enough to predict currently.

And, as with utility companies, and the long running concerns over pricing and profits etc. I know that its likely I'm always going to need or be a customer of certain companies, so I might as well be a shareholder and for a small upfront investment, benefit year on year, in much the same way as if they were co-operatives.

If Google, or any other company, is going to be servicing you and your family, and your society, and the world over a lifetime, and be profitable, then they seem to be prime candidates for a long term, low maintenance portfolio regardless of economic cycles.

So it seems to be a difficult judgement (and one I'm struggling with), being patient but then recognising when the price range is acceptable against the long term story rather than trying to get THE best price.

Saturday, 9 May 2015

April 2015: Portfolio Update

So with April coming to a close, and early May bringing the UK General Elections for 2015, and after months of poll data suggesting various permutations of a hung parliament that had threatened to produce a long drawn out period of uncertainty, the outcome has instead been a more decisive shock and awe result.

UK markets and indices have zigged and zagged with increasing volatility as the May 7th date came closer, and then surged, along with sterling, after the unexpectedly clean result produced a party majority.

In line with that, or in spite of it, the FTSE 100 has still managed to create new all time highs in 2015 and breach the near mythical promised land beyond 7000.

And, more satisfyingly my own portfolio has also continued to achieve new highs this year, with April's close marking a total 129.83% gain in the 5 years and 4 months since I started measuring and working with this portfolio.

Anyway the last month has seen a bounce in Microsoft (+15.52%), after a better than expected quarterly update (Interesting end to the week!), and R-R (+9.76%), after its own well received news of a new CEO and a record order.

Elsewhere, BG Group surged 42.58%, following a confirmed and agreed bid from Royal Dutch Shell (BG Group shelling out?).

BP has also basked in the searchlight for potential bid targets, with a gain of +7.55%, as well as being buoyed by a recovering oil price.

Imperial Tobacco has also benefited from analyst upgrades ahead of a well recieved trading update in May.

Apple initially surged, in aftermarket trading, to new highs of circa $134, after posting another good set of pre- Apple Watch quarterly results, but have since pulled back with the wider sentiment in American markets (Interesting end to the week!).

William Hill also suffered after an update included the impact of a bad week of football results continuing to hold back performance (Interesting end to the week!).

Other holdings, BAE, SSE, Centrica, Barratt, BAT, along with Imperial Tobacco and William Hill, were also hampered with pre-election concerns.

As mentioned in my previous post reviewing 2014 dividends 2014 Dividends Profiled., April is a poor dividend month for my portfolio with, as suggested, the only receipt coming from GE.

So in a difficult volatile month ahead of May's General Election, my portfolio managed a gain of +3.78% v. +2.77% by the FTSE100, making +9.96% for the year to date.

Its worth noting that sterling strengthened against the dollar too, rising to $1.536 from $1.483, which does impact recent gains in my US$ holdings: Apple, GE, Microsoft, and Verizon, as they convert back into sterling.

I have also added new funds, and made an additional purchase in BG Group ahead of the deal with Royal Dutch Shell.

By using a unit price, the funds go in at nil gain.

Its a slight gamble given the timescale and planned completion next year but, with my expectation being that it will go through I feel there is a premium to be gained by topping up in this way (BG Group shelling out?), and looking to find myself with a holding in the higher yielding Royal Dutch Shell.

Clearly I'm also expecting a higher oil price eventually for both Royal Dutch Shell and BP to maintain dividends and renew share price gains.

Looking ahead, the General Election (as we now know), did continue to affect markets with surges and pull backs, and, a further surge following the unexpectedly quick and decisive outcome.

I'm sure that won't be the end of it though as more questions and uncertainty continue to show up on the horizon such as the future of Greece in Europe, the future of the UK in Europe, and the future of the UK even?

And this on top of the usual questions of Chinese demand and global economic growth, relationships with Russia, and the Middle East.

It really doesn't ever end, does it?

But, I am also watching a few shares (I have missed a few too it seems), and hope to make further purchases in the coming months.

Good luck.

UK markets and indices have zigged and zagged with increasing volatility as the May 7th date came closer, and then surged, along with sterling, after the unexpectedly clean result produced a party majority.

In line with that, or in spite of it, the FTSE 100 has still managed to create new all time highs in 2015 and breach the near mythical promised land beyond 7000.

And, more satisfyingly my own portfolio has also continued to achieve new highs this year, with April's close marking a total 129.83% gain in the 5 years and 4 months since I started measuring and working with this portfolio.

Anyway the last month has seen a bounce in Microsoft (+15.52%), after a better than expected quarterly update (Interesting end to the week!), and R-R (+9.76%), after its own well received news of a new CEO and a record order.

Elsewhere, BG Group surged 42.58%, following a confirmed and agreed bid from Royal Dutch Shell (BG Group shelling out?).

BP has also basked in the searchlight for potential bid targets, with a gain of +7.55%, as well as being buoyed by a recovering oil price.

Imperial Tobacco has also benefited from analyst upgrades ahead of a well recieved trading update in May.

Apple initially surged, in aftermarket trading, to new highs of circa $134, after posting another good set of pre- Apple Watch quarterly results, but have since pulled back with the wider sentiment in American markets (Interesting end to the week!).

William Hill also suffered after an update included the impact of a bad week of football results continuing to hold back performance (Interesting end to the week!).

Other holdings, BAE, SSE, Centrica, Barratt, BAT, along with Imperial Tobacco and William Hill, were also hampered with pre-election concerns.

As mentioned in my previous post reviewing 2014 dividends 2014 Dividends Profiled., April is a poor dividend month for my portfolio with, as suggested, the only receipt coming from GE.

So in a difficult volatile month ahead of May's General Election, my portfolio managed a gain of +3.78% v. +2.77% by the FTSE100, making +9.96% for the year to date.

Its worth noting that sterling strengthened against the dollar too, rising to $1.536 from $1.483, which does impact recent gains in my US$ holdings: Apple, GE, Microsoft, and Verizon, as they convert back into sterling.

I have also added new funds, and made an additional purchase in BG Group ahead of the deal with Royal Dutch Shell.

By using a unit price, the funds go in at nil gain.

Its a slight gamble given the timescale and planned completion next year but, with my expectation being that it will go through I feel there is a premium to be gained by topping up in this way (BG Group shelling out?), and looking to find myself with a holding in the higher yielding Royal Dutch Shell.

Clearly I'm also expecting a higher oil price eventually for both Royal Dutch Shell and BP to maintain dividends and renew share price gains.

Forecast

|

1 month

|

YTD

|

52 mth

| ||||||||||||||||||||||

Price

|

% holding

|

Div. yield

|

% gain

|

% gain

|

% gain

| ||||||||||||||||||||

R-R

| 1046.00p |

24.89%

|

2.27%

|

9.76%

|

20.23%

|

59.34%

| |||||||||||||||||||

Aviva

| 527.00p |

12.55%

|

4.01%

|

-2.41%

|

8.77%

|

45.66%

| |||||||||||||||||||

National Grid

| 879.00p |

12.71%

|

5.09%

|

1.62%

|

-4.26%

|

58.95%

| |||||||||||||||||||

BP

| 470.00p |

9.62%

|

5.56%

|

7.55%

|

14.36%

|

11.07%

| |||||||||||||||||||

Apple **

| $125.15 |

8.37%

|

1.36%

|

-2.87%

|

15.08%

|

123.86%

| |||||||||||||||||||

IG Group

| 737.00p |

4.36%

|

4.25%

|

3.95%

|

2.50%

|

54.44%

| |||||||||||||||||||

Imperial Tobacco

| 3192.00p |

2.94%

|

4.40%

|

7.73%

|

12.55%

|

41.30%

| |||||||||||||||||||

William Hill

| 361.00p |

2.70%

|

3.51%

|

-2.70%

|

-0.41%

|

96.01%

| |||||||||||||||||||

BAT

| 3592.00p |

2.24%

|

4.35%

|

2.98%

|

2.63%

|

7.09%

| |||||||||||||||||||

Vodafone

| 231.00p |

2.08%

|

5.10%

|

5.00%

|

3.75%

|

-8.44%

| |||||||||||||||||||

Microsoft **

| $48.64 |

2.14%

|

2.09%

|

15.52%

|

6.29%

|

76.94%

| |||||||||||||||||||

Banco Santander

| 488.00p |

1.87%

|

2.78%

|

-3.17%

|

-10.38%

|

-10.57%

| |||||||||||||||||||

General Electric **

| $27.08 |

1.89%

|

2.90%

|

5.40%

|

8.77%

|

80.31%

| |||||||||||||||||||

BAE Systems

| 508.00p |

1.67%

|

4.12%

|

-3.05%

|

7.63%

|

53.94%

| |||||||||||||||||||

Barratt Dev.

| 519.00p |

1.52%

|

4.45%

|

-1.89%

|

10.19%

|

45.19%

| |||||||||||||||||||

SSE

| 1547.00p |

1.40%

|

5.92%

|

3.27%

|

-4.62%

|

26.29%

| |||||||||||||||||||

Verizon **

| 3284.86p |

1.41%

|

3.75%

|

0.16%

|

9.44%

|

18.36%

| |||||||||||||||||||

Centrica

| 255.00p |

1.05%

|

4.92%

|

0.79%

|

-8.60%

|

-23.10%

| |||||||||||||||||||

BG Group

| 1182.00p |

2.71%

|

1.89%

|

42.58%

|

36.65%

|

-3.83%

| |||||||||||||||||||

Cash

|

1.89%

|

0.00%

| |||||||||||||||||||||||

100.00%

|

3.50%

| ||||||||||||||||||||||||

1 month

|

YTD

|

52 mth

| |||||||||||||||||||||||

| Virtual Portfolio gain (incl. Dividends) | |||||||||||||||||||||||||

| - 1 month gain 2214.53 - | 2298.27 |

3.78%

| |||||||||||||||||||||||

| - YTD gain 1644.62 - | 2298.27 |

9.96%

| |||||||||||||||||||||||

| - 52 month gain 1264.20 - | 2298.27 |

81.80%

| |||||||||||||||||||||||

| - 64 month gain 1000.00 - | 2298.27 |

129.83%

| |||||||||||||||||||||||

| FTSE gain (excl. Dividends) | |||||||||||||||||||||||||

| - 1 month gain 6773.04 - | 6960.63 |

2.77%

| |||||||||||||||||||||||

| - YTD gain 5897.81 - | 6960.63 |

6.01%

| |||||||||||||||||||||||

| - 52 month gain 5971.01 - | 6960.63 |

16.57%

| |||||||||||||||||||||||

| - 64 month gain 5412.88 - | 6960.63 |

28.59%

| |||||||||||||||||||||||

| Transactions: | |||||||||||||||||||||||||

| 10/04/2015 | Charges | ||||||||||||||||||||||||

| 10/04/2015 | Buy | Funds added @ 2.215 (April Index close) | |||||||||||||||||||||||

| 10/04/2015 | Buy | BG @ 407.39p per share | |||||||||||||||||||||||

| 29/04/2015 | Div | General Electric @ 12.72p per share | |||||||||||||||||||||||

| Notes: | |||||||||||||||||||||||||

| * US Dividends are adjusted for exchange rate and 15% withholding tax | |||||||||||||||||||||||||

| ** Sterling : Dollar exchange rate = £1: $1.53553 as at 30/04/15 | |||||||||||||||||||||||||

| *** Banco Dividends are adjusted for exchange rate and 21% withholding tax | |||||||||||||||||||||||||

| **** Sterling : Euro exchange rate = £1: $1.36933 as at 30/04/15 | |||||||||||||||||||||||||

As mentioned last month, I have also had to increase the scale to accommodate new highs, which present a satisfying picture.

|

| Click to enlarge, close to return. |

I'm sure that won't be the end of it though as more questions and uncertainty continue to show up on the horizon such as the future of Greece in Europe, the future of the UK in Europe, and the future of the UK even?

And this on top of the usual questions of Chinese demand and global economic growth, relationships with Russia, and the Middle East.

It really doesn't ever end, does it?

But, I am also watching a few shares (I have missed a few too it seems), and hope to make further purchases in the coming months.

Good luck.

Related Posts:

Previous Posts:

Labels:

Apple,

Barratt Developments,

BAT,

BG,

BP,

Centrica,

GE,

Imperial Tobacco,

Microsoft,

Portfolio,

Royal Dutch Shell,

SSE,

Verizon Communications,

William Hill

Subscribe to:

Comments (Atom)