I think there was probably also an unmarked intra month high exceeding my previously posted observation (Interesting end to the week!).

Anyway, William Hill quietly took the laurels during May with a 16.59% gain going largely unnoticed as the company continues to benefit from a post election buzz.

Barratt, Centrica, and SSE also continued to benefit from the same momentum.

And, almost immediately after my post observing the market's reaction to Vodafone's results (Vodafone "off the hook"?), the share price bounced with rumours of mergers and tie-ups.

Apple, IG, and National Grid also added to the feel good momentum, and combined with the numerous dividends this month, facilitated a 1.46% gain in the month.

Aviva weighed in with the largest dividend contribution, with others also coming from BAT, Verizon, BG, Barratt, Banco-Santander and Apple.

In contrast, the FTSE100 notched up a 0.34% gain.

| Forecast | 1 month | YTD | 53 mth | ||||||

| Price | % holding | Div. yield | % gain | % gain | % gain | ||||

| R-R | 998.00p | 23.41% | 2.38% | -4.59% | 14.71% | 52.02% | |||

| Aviva | 523.50p | 12.28% | 4.03% | -0.66% | 8.05% | 44.70% | |||

| National Grid | 934.00p | 13.31% | 4.79% | 6.26% | 1.73% | 68.90% | |||

| BP | 450.75p | 9.09% | 5.79% | -4.10% | 9.67% | 6.52% | |||

| Apple ** | $130.28 | 8.72% | 1.31% | 5.69% | 21.64% | 136.61% | |||

| IG Group | 781.50p | 4.55% | 4.01% | 6.04% | 8.69% | 63.77% | |||

| Imperial Tobacco | 3370.00p | 3.06% | 4.17% | 5.58% | 18.83% | 49.18% | |||

| William Hill | 420.90p | 3.10% | 3.01% | 16.59% | 16.11% | 128.53% | |||

| BAT | 3605.50p | 2.22% | 4.33% | 0.38% | 3.01% | 7.49% | |||

| Vodafone | 255.35p | 2.26% | 4.61% | 10.54% | 14.69% | 1.21% | |||

| Microsoft ** | $46.86 | 2.06% | 2.17% | -2.19% | 3.97% | 73.08% | |||

| Banco Santander | 466.00p | 1.76% | 2.86% | -4.51% | -14.42% | -14.61% | |||

| General Electric ** | $27.27 | 1.90% | 2.88% | 2.24% | 11.21% | 84.36% | |||

| BAE Systems | 515.00p | 1.66% | 4.07% | 1.38% | 9.11% | 56.06% | |||

| Barratt Dev. | 592.00p | 1.71% | 3.90% | 14.07% | 25.69% | 65.61% | |||

| SSE | 1665.00p | 1.49% | 5.50% | 7.63% | 2.65% | 35.92% | |||

| Verizon ** | 3269.01p | 1.38% | 3.82% | -0.48% | 8.92% | 17.79% | |||

| Centrica | 277.60p | 1.13% | 4.52% | 8.86% | -0.50% | -16.28% | |||

| BG Group | 1137.00p | 2.57% | 1.97% | -3.81% | 31.45% | -7.49% | |||

| Cash | 2.32% | 0.00% | |||||||

| 100.00% | 3.46% | ||||||||

| 1 month | YTD | 53 mth | |||||||

| Virtual Portfolio gain (incl. Dividends) | |||||||||

| - 1 month gain 2298.27 - | 2331.79 | 1.46% | |||||||

| - YTD gain 1644.62 - | 2331.79 | 11.56% | |||||||

| - 53 month gain 1264.20 - | 2331.79 | 84.45% | |||||||

| - 65 month gain 1000.00 - | 2331.79 | 133.18% | |||||||

| Unit Price - £ | 2.33179 | (Starting price - £1) | |||||||

| FTSE gain (excl. Dividends) | |||||||||

| - 1 month gain 6960.63 - | 6984.43 | 0.34% | |||||||

| - YTD gain 5897.81 - | 6984.43 | 6.37% | |||||||

| - 53 month gain 5971.01 - | 6984.43 | 16.97% | |||||||

| - 65 month gain 5412.88 - | 6984.43 | 29.03% | |||||||

| Transactions: | |||||||||

| 06/05/2015 | Div | Verizon @ 30.79p per share | |||||||

| 07/05/2015 | Div | BAT @ 100.60p per share | |||||||

| 08/05/2015 | Div | Banco Santander @ 8.74p per share | |||||||

| 15/05/2015 | Div | Aviva @ 12.25p per share | |||||||

| 18/05/2015 | Div | Apple @ 27.90p per share | |||||||

| 20/05/2015 | Div | Barrat Dev. @ 4.80p per share | |||||||

| 22/05/2015 | Div | BG Group @ 9.52p per share | |||||||

| Notes: | |||||||||

| * US Dividends are adjusted for exchange rate and 15% withholding tax | |||||||||

| ** Sterling : Dollar exchange rate = £1: $1.51239 as at 31/05/15 | |||||||||

| *** Banco Dividends are adjusted for exchange rate and 21% withholding tax | |||||||||

| **** Sterling : Euro exchange rate = £1: $1.39106 as at 31/05/15 | |||||||||

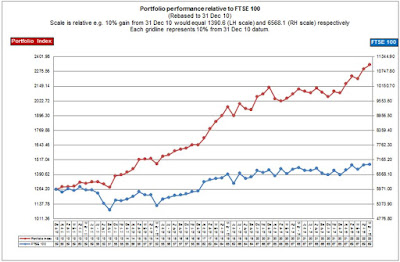

The chart is now showing a new sharply rising trend that started in January 2015 and has continued to move away from the FTSE100.

|

| Click to enlarge, close to return. |

Despite markets now potentially moving into the mid year doldrums, ongoing concerns around global growth affecting supply and demand in oil and commodities, and Grexit fears, June, through to August looks a good period for portfolio dividends given contributions from R-R, BP, National Grid, and Imperial Tobacco, to look forward to.

And despite still kicking myself over the ones that might have got away, I am still watching, and waiting.

Lloyd's is going to be a difficult one to judge given the news that the Gov't plan to sell off the rump of the remainder. Will that discount the current price?

Bellway is still climbing but the North East construction specialist continues to trade at a discount to the sector trading at a forward price to earnings of 10 (8 times was available pre-election!).

And, following its own break-up, BHP Billiton, is now trading on a forward pe of 14.8 rising to 20.4, supported by a dividend of 5.8 - 6%.

I also need to sit down and calculate some comparisons with VW given the continued weakening of the Euro which might be giving me another chance to drive away a new purchase!

Anyway, we continue to trade in stormy waters but markets are holding up surprisingly well.

Related Posts:

- Interesting end to the week!

- Vodafone "off the hook"?

- Additional News to the post: Vodafone "off the hook"?

- Dividend Pipeline!

No comments:

Post a Comment